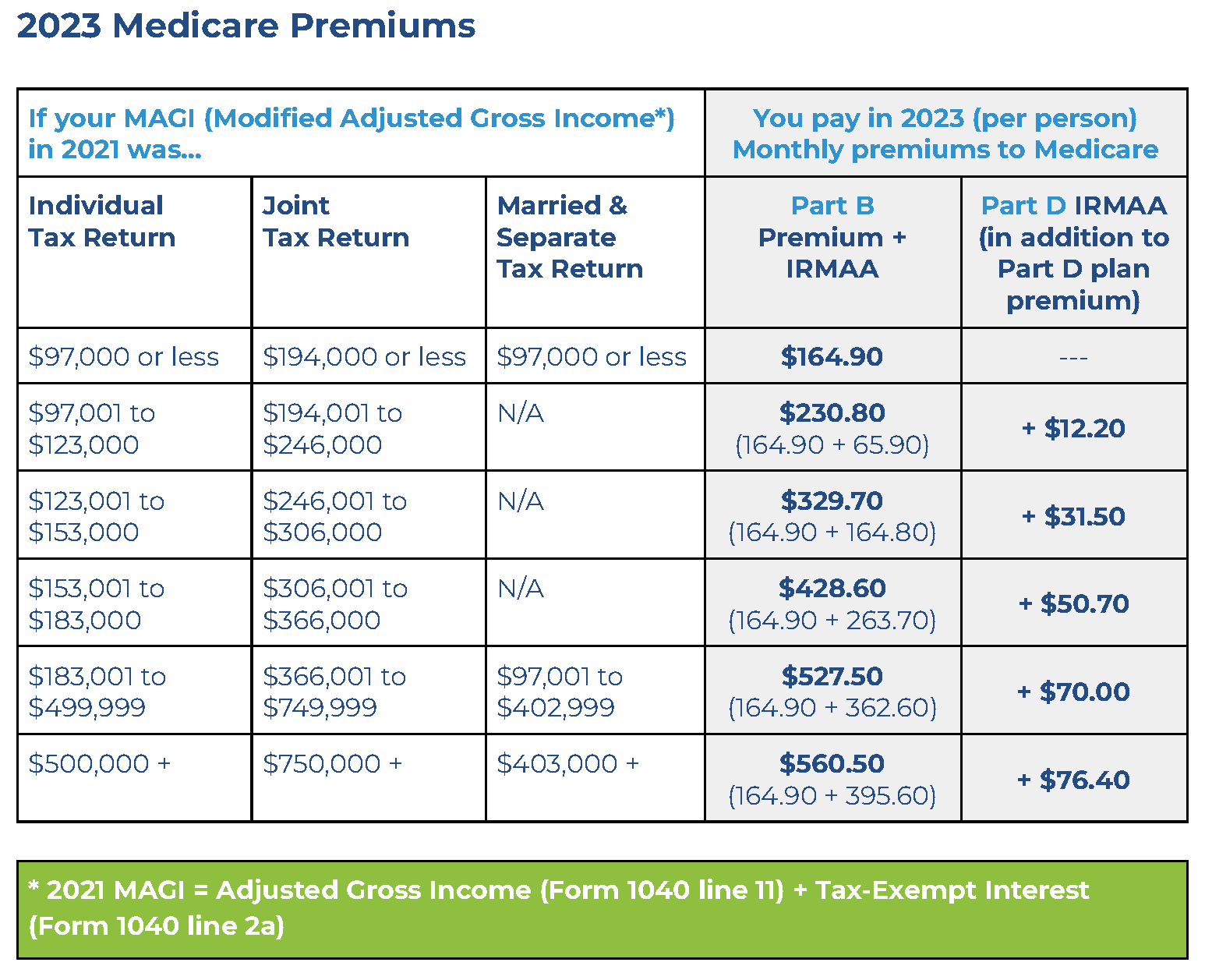

What Are Medicare Income Limits For 2025 - Your 2025 irmaa fees will be based on your 2025 income. 2025 Medicare Limits Faunie Maurita, If income exceeds these limits, individuals pay. Married, joint filing 2025 medicare part b monthly premium 2025 medicare part d monthly premium;

Your 2025 irmaa fees will be based on your 2025 income.

Abd Medicaid Limit 2025 Noemi Angeline, The annual deductible for all medicare part b beneficiaries will be $240 in 2025, an increase of $14 from the annual deductible. What you need to know.

How Much Are Medicare Premiums In 2025 Lotti Rhianon, 2025 medicare part b income caps unveiled: Those numbers are based on your income on your 2025 tax return.

Mo Medicaid Limits 2025 Gayla Johanna, Married, joint filing 2025 medicare part b monthly premium 2025 medicare part d monthly premium; Medicare looks at your modified adjusted gross income as reported 2 years prior on your irs tax returns.

Affordable Health Care Limits 2025 Devin Feodora, Your 2025 irmaa fees will be based on your 2025 income. The estimated average payment will go up by $59, to $1,907 from $1,848.

.png)

Medicare looks at your modified adjusted gross income as reported 2 years prior on your irs tax returns.

What Are Medicare Income Limits For 2025. Income threshold and rates from. Medicare looks at your modified adjusted gross income as reported 2 years prior on your irs tax returns.

Medicare Tax Limits 2025 Jodi Rosene, Married, joint filing 2025 medicare part b monthly premium 2025 medicare part d monthly premium; There's no wage base limit for medicare.

2025 medicare part b income caps unveiled: Monthly medicare premiums for 2025.

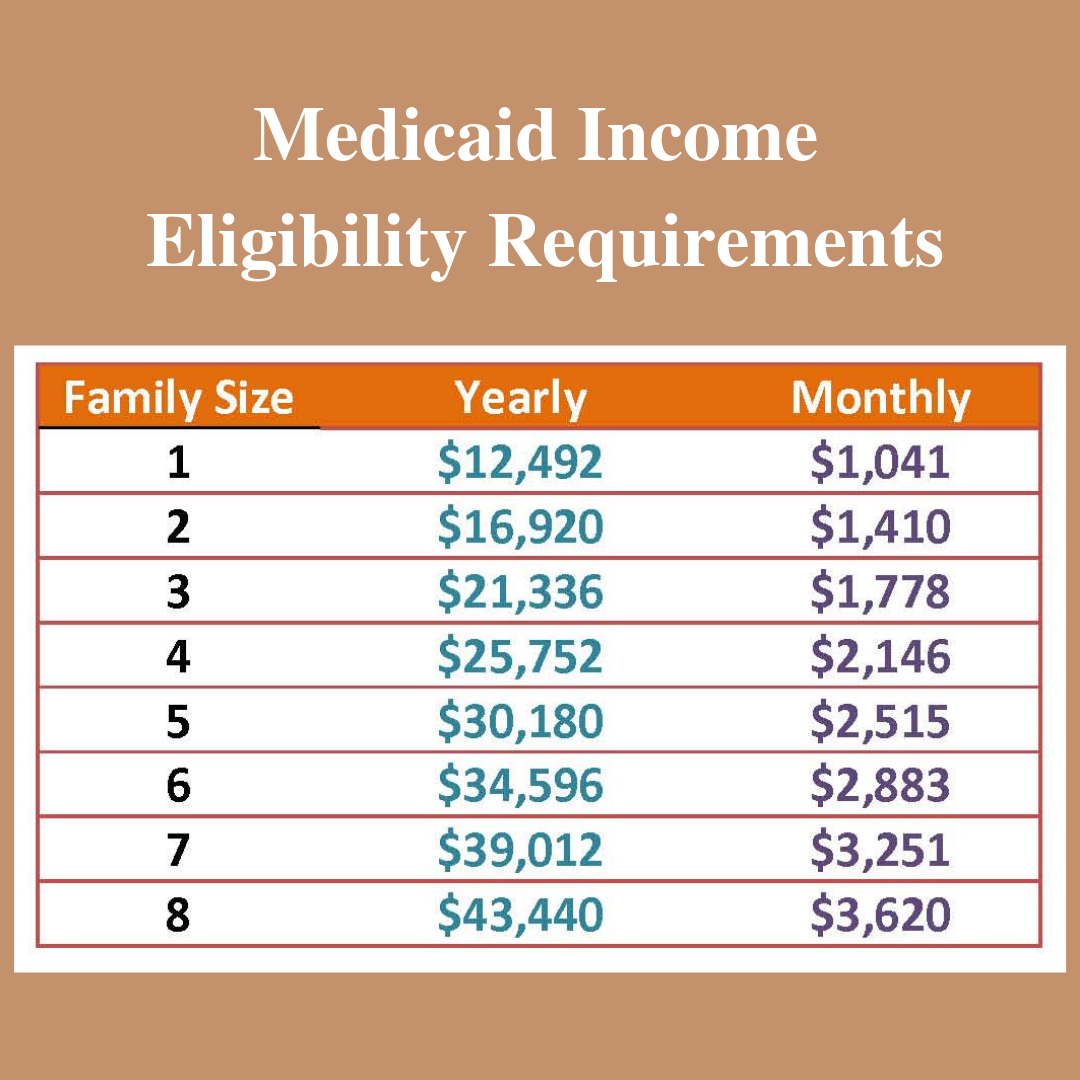

Medicare Premiums For High Earners 2025 Terra, The annual deductible for all medicare part b beneficiaries will be $240 in 2025, an increase of $14 from the annual deductible. Medicaid vs medicare income limits.

Email from regulations coordinator, hhs, to senior staff attorney, gao, subject:

Medicare Premiums Limits 2025 Twila Ingeberg, The annual deductible for all medicare part b beneficiaries will be $240 in 2025, an increase of $14 from the annual deductible. Email from regulations coordinator, hhs, to senior staff attorney, gao, subject: